In the preceding example the May 24 unit would be assumed to have been sold. If Monnisto had used the LIFO cost flow assumption in the same year its cost of goods sold would have been 44210 more than under FIFO and its average assets would have been 34150.

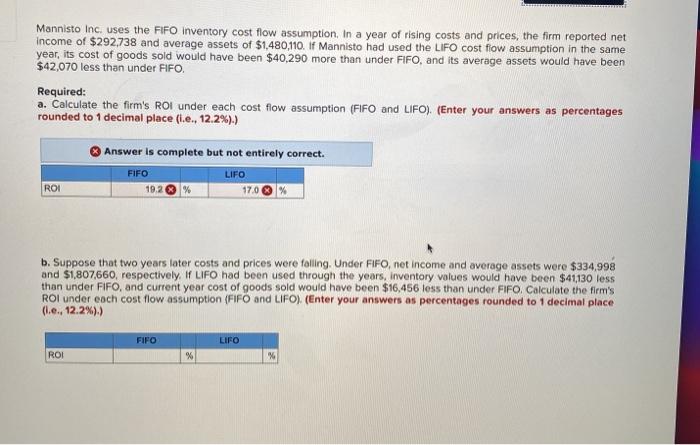

Solved Mannisto Inc Uses The Fifo Inventory Cost Flow Chegg Com

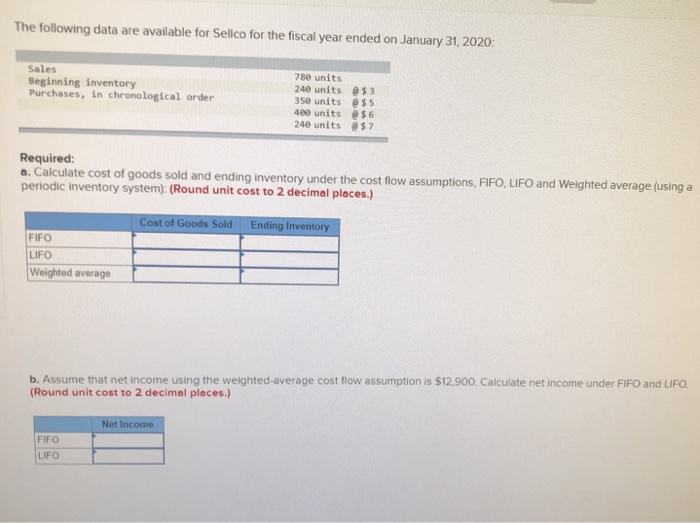

Accounting questions and answers.

. LIFO conformity rule It does not coincide with the actual movement of goods. Business Accounting QA Library Mannisto Inc. Cost flow assumptions are timing issues.

If the company had used the LIfO cost-flow assumption in the same year its cost of goods sold would have been 80000 more than under FIFO and its average assets would have been. If Natco had used the LIFO cost-flow assumption in the same year its cost of goods sold would have been 80000 more than under FIFO and its average assets would have been. In a year of rising costs and prices the firm reported net income of 219138 and average assets of 1552940.

Thus the gross profit would be 11 and the ending inventory would be 27 13 14. In a year of rising costs and prices the firm reported net income of 224988 and average assets of 1558950. In a year of rising costs and prices the firm reported net income 480000 and average assets of 3000000.

Up to 25 cash back A company uses the FIFO inventory cost-flow assumption. Inventory cost presented on the Balance Sheet is not close to current value. If Mannisto had used the LIFO cost flow assumption in the same year its cost of goods sold would have been 35110 more than under FIFO and its average assets would have been 31140.

Under the last in first out method you assume that the last item purchased is also the first one sold. Cost of goods sold will be the same as if FIFO were used. Uses the FIFO Inventory cost flow assumption.

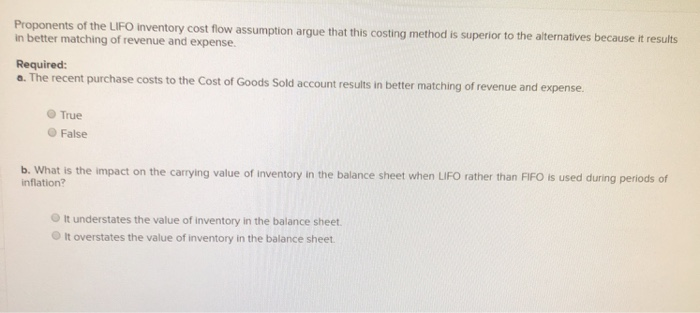

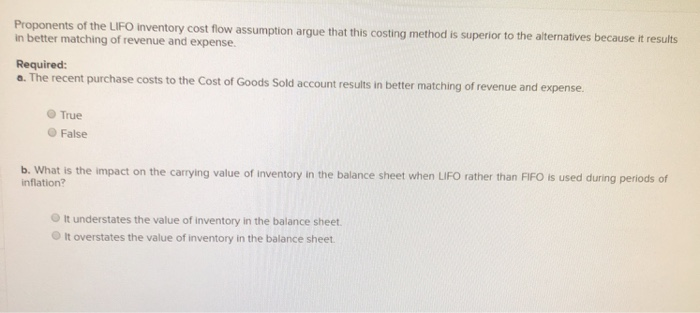

Net income will be greater than if FIFO were used. Better matching of revenue and expense is achieved than under FIFO. A higher selling price can be established.

A cost of goods sold will be greater than if FIFO were used. When a firm uses the LIFO inventory cost flow assumption. Better matching of revenue and expense is achieved than under FIFO.

Uses the FIFO inventory cost flow assumption. It does not coincide with the actual movement of goods. The inventory cost flow assumption describes the flow of product cost.

Cost of goods sold will be the same as if FIFO were used. One of the principal reasons for selecting the LIFO cost flow assumption instead of the FIFO cost flow assumption in an inflationary economic environment is that. Under LIFO the most recent costs incurred for merchandise purchased or manufactured are transferred to the income statement as Cost of Goods Sold when items are sold and the inventory on hand at the balance sheet date.

Over the life of the firm the total cost of goods sold for financial reporting and tax purposes must be equal to the total price paid for inventory. Under the last-in first-out LIFO inventory cost flow method the last units purchased are assumed to be sold and the ending inventory is made up of the first purchases. LIFO Cost Flow Assumption last-in first-out This cost flow assumption was developed for tax purposes.

Income taxes will be lower. Net income will be greater than if FIFO were used. In a year of rising costs and prices the firm reported net income of 262952 and average assets of 1590420.

In a year of rising costs and prices the firm reported net income of 1920000 and average assets of 12000000. Better matching of revenue and expense is achieved than under FIFO. If Mannisto had used the LIFO cost flow assumption in the same year its cost of goods sold would have been 43570 more than under FIFO and its average assets would have.

Cost of goods sold will be greater than if FIFO were used. In a year of rising costs and prices the firm reported net income of 255987 and average assets of 1412450. D better matching of revenue and expense is achieved than under FIFO.

Total current assets are not affected. In a year of rising costs and prices the firm reported net income of 480000 and average assets of 3000000. B net income will be greater than if FIFO were used.

However because of tax law requirements if a company uses this assumption for tax purposes it must also use it for its financial statements. When a firm uses the LIFO inventory cost flow assumption. Since this is the highest-cost item in the example profits would be lowest under LIFO.

Balance sheet inventory values will be higher. Better matching of revenue and expense is achieved than under FIFO Accounts receivable are reported at. If Mannisto had used the LIFO cost flow assumption in the same year its cost of goods sold would have been 320000 more than under FIFO and its average assets would.

Disadvantages of LIFO. Net income will be greater than if FIFO were used. Thus the gross profit would be.

LIFO cost flow assumption. In a year of rising costs and prices the firm reported net income of 1500000 and average assets of 10000000. Mannisto Inc uses the FIFO inventory cost flow assumption.

Uses the FIFO inventory cost flow assumption. Better matching of revenue and expense is achieved than under FIFO. Natco Inc uses the FIFO inventory costflow assumption.

LIFO results in significantly understated inventory values assets if it has been used for. From the asset inventory account and to the expense cost of goods sold account. About cost flow not physical flow and it is possible for a firm to have a FIFO physical flow like the grocery store and still use the LIFO cost flow assumption.

When a firm uses the LIFO inventory cost flow assumption. C cost of goods sold will be the same as if FIFO were used. However because of tax law requirements if a company uses this assumption for tax purposes it must also use it for its financial statements.

When a firm uses the LIFO inventory cost flow assumption better matching of revenue and expense is achieved than under FIFO The allowance for uncollectible accounts is an. If Mannisto had used the LIFO cost flow assumption in the same year its cost of goods sold would have been 300000 more than under FIFO and its average assets would have been 300000 less than. When a firm uses the LIFO inventory cost flow assumption.

When a firm uses the LIFO inventory cost flow assumption. LIFO is used during inflationary times to defer income tax payments. Uses the FIFO inventory cost flow assumption.

Cost of goods sold will be the same as if FIFO were used. Net income will be higher. When a firm uses the LIFO inventory cost flow assumption.

If Mannisto had used the LIFO cost flow assumption in the same year its cost of goods sold would have been 32360 more than under FIFO and its average assets would have been 33860 less than under FIFO. First-out This cost flow assumption was developed for tax purposes. Mannisto Inc uses the FIFO inventory cost flow assumption.

Thus the cost of goods sold would be 90. LIFO is used during inflation to defer income tax. Cost of goods sold will be greater than if FIFO were used.

Cost of goods sold will be greater than if FIFO were used.

Solved Mannisto Inc Uses The Fifo Inventory Cost Flow Chegg Com

Solved Proponents Of The Lifo Inventory Cost Flow Assumption Chegg Com

Solved Proponents Of The Lifo Inventory Cost Flow Assumption Chegg Com

0 Comments